Securing financing for investment properties isn’t always easy. Oftentimes, real estate investors must provide full diligence packages for lenders in order to qualify for financing. DSCR loans provide an alternative to conventional financing when borrowers may not have the personal income to qualify for a mortgage.

Instead of relying on personal income, DSCR loans evaluate whether a property’s rental income can cover its debt, making them an attractive financing optio

This blog will explore how DSCR loans can unlock real estate investment potential by providing flexible financing for property purchases and rental investments.

What is the Debt Service Coverage Ratio (DSCR) in Real Estate?

The Debt Service Coverage Ratio (DSCR) in real estate is a financial metric used by lenders and investors to assess the ability of an income-generating property to cover its debt obligations. It compares the property’s net operating income (NOI) to its debt payments (principal and interest).

The formula for DSCR is:

- A DSCR greater than 1 means the property generates more income than the debt payments, indicating the property can comfortably cover its debt.

- A DSCR less than 1 means the property’s income isn’t enough to cover its debt, suggesting a higher risk for lenders.

Real estate investors use this ratio to determine whether a property can sustain its financial obligations. Lenders can also use it to evaluate whether to approve a loan, especially for investment properties.

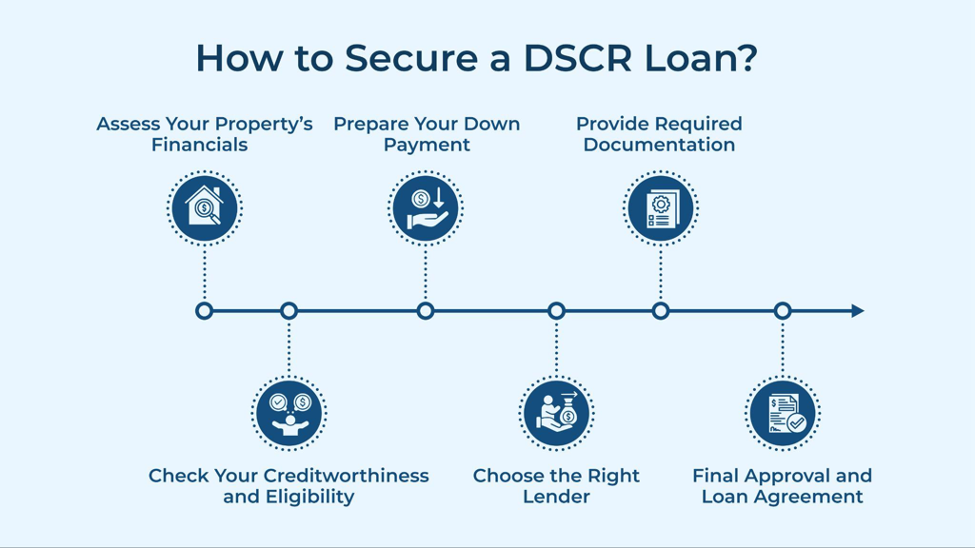

How to Secure a DSCR Loan?

Securing a Debt Service Coverage Ratio (DSCR) loan involves carefully preparing and understanding your financial standing. Here’s a breakdown of the process:

1. Assess Your Property’s Financials

The first step is to evaluate the Net Operating Income (NOI) of the property you want to finance. The lender will want to see if the income generated from the property is sufficient to cover the debt payments. Make sure to account for all income and expenses, such as rent and maintenance costs, to get an accurate picture of your property’s financial health.

2. Check Your Creditworthiness and Eligibility

Even though DSCR is the primary indicator of loan eligibility, your credit score will still play a role. So, how do you qualify for a DSCR loan? Lenders will review your credit history to assess your ability to manage financial obligations. Ensure that your credit score is in good shape, as it could influence the terms and interest rates of the loan.

3. Prepare Your Down Payment

Most lenders require a down payment of 20% to 25% of the property’s purchase price. The exact amount depends on the lender’s requirements and the type of property you’re purchasing. Be prepared to show proof of funds for the down payment during the loan application process.

4. Choose the Right Lender

Different lenders have varying criteria for DSCR loans. Some may offer more favorable terms depending on the property type (residential vs. commercial) or the location. Shopping around and comparing options is essential to secure the best terms that align with your investment goals

.

5. Provide Required Documentation

You’ll need to submit various documents as part of your loan application. Common requirements include:

- Property financials (NOI, profit and loss statements)

- Personal financial documents (tax returns, credit history)

Be sure to have all documentation ready to streamline the approval process.

6. Final Approval and Loan Agreement

Once your application is submitted, the lender will review your DSCR, credit score, proof of funds, and other documents. You’ll receive an offer outlining the loan amount, interest rates, repayment terms, and other conditions if approved. Review the loan agreement carefully before accepting.

By following these steps, you can increase the chances of successfully securing a DSCR loan. Look for real estate market trends affecting DSCR loans to ensure you get the best deal.

How Do Real Estate Investors Use DSCR Loans?

Real estate investors use the Debt Service Coverage Ratio (DSCR) to assess whether a property can generate enough income to cover its debt payments.

For instance, if an investor is considering buying a rental property priced at $150,000, they may first check the lender’s DSCR requirement – let’s assume in this case it is 1.40x.

If the property generates a monthly net operating income (NOI) of $7,500, the investor can use the DSCR formula to determine the maximum debt service the lender will allow. The formula can be rearranged as follows:

DSCR = NOI / Debt Service

Debt Service = NOI / DSCR

So, $7,500 NOI / 1.40 DSCR = $5,357 Debt Service (Principal + Interest)

With this calculation, the investor knows the maximum debt payment allowed is $5,357 annually. After discussing with the lender, they also learn that a 30% down payment is required to meet the DSCR requirement. Using the DSCR formula, the investor can continue shopping for properties that meet their down payment budget and the lender’s DSCR requirements.

For example, if the investor has $25,000 to allocate for a down payment and the lender requires a DSCR of 1.35, they can search for rental properties that match their budget and meet the necessary financial metrics.

How DSCR Loans Unlock Investment Potential

Here’s how DSCR loans enable investors to tap into greater opportunities:

1. Easy Qualification Based on Property Income

A critical advantage of DSCR loans is that they are primarily based on the property’s Net Operating Income (NOI). This allows investors with less-than-perfect credit or lower personal income to qualify for loans if the property generates sufficient rental income. This can be especially beneficial for investors seeking to build a portfolio of income-generating properties.

2. Utilize Investment Opportunities

With DSCR loans, investors can purchase multiple properties or refinance existing properties more efficiently as long as the properties meet the required debt service coverage ratio. By ensuring that the property’s income exceeds the debt payments, investors can leverage their real estate holdings, take on more debt and comfortably manage portfolio risk. This means they can scale their portfolio faster, increasing their potential returns without overextending financially.

3. Access to Larger Loan Amounts

Since DSCR loans focus on the property’s cash flow rather than personal income, they can potentially offer higher loan amounts than standard financing methods. This is particularly helpful for investors looking to purchase more expensive properties or explore high-demand markets. With access to additional capital, investors can take on larger projects and scale their portfolio quickly.

4. Financial Flexibility and Long-Term Growth

DSCR loans help investors balance cash flow management with long-term growth by offering flexible repayment options and competitive terms. Investors can use the property’s rental income to cover debt payments, allowing them to retain more capital for reinvestment in other properties. This financial flexibility limits financial strain and promotes sustainable growth over their entire real estate portfolio

5.Minimize Personal Risk

Since DSCR loans rely on the property’s income for approval, the investor’s financial situation carries less weight in the approval process. This helps minimize personal financial risk. The investor is primarily accountable for the property’s income, meaning the risk is lower if the property performs well. This provides peace of mind and encourages investors to take on a variety of projects, diversifying their overall investment strategy.

6. More Attractive for High-Demand Markets

DSCR loans provide a way for investors to compete in competitive or high-demand markets. Whether purchasing residential or commercial properties, investors can secure funding based on the property’s financial potential, making it easier to take advantage of prime investment opportunities before other buyers snatch them up.

Common Mistakes with DSCR Real Estate Loans

When applying for a DSCR real estate loan, investors often make common mistakes that can hinder approval or lead to unfavorable terms.

Overestimating a Property’s Rental Income

Investors sometimes assume they can charge higher rents without verifying actual market rates. Lenders assess rental income based on current leases, not projections. If the projected revenue is unrealistic, it can negatively impact DSCR calculations. Conducting thorough market research ensures rental estimates align with lender expectations.

Ignoring Additional Property Costs

Many investors overlook maintenance, property management fees, taxes, and insurance costs. These expenses lower the net operating income (NOI) and weaken the DSCR. Underestimating expenses can lead to financial strain and potential loan denial.

Failing to Meet Lender Requirements

Lenders have specific DSCR thresholds, credit score requirements, and down payment expectations. Assuming a strong DSCR alone guarantees approval is a mistake. Poor credit or insufficient funds can still result in rejection. Reviewing lender criteria beforehand helps avoid unnecessary application rejections.

Overlooking Market Fluctuations

Real estate markets are unpredictable, and rental income or property values can decline. Ignoring potential downturns may lead to difficulties in meeting debt obligations. Investors should assess economic trends and plan for vacancies or rent reductions. A conservative approach ensures long-term financial stability.

Avoiding these mistakes requires careful planning, accurate financial projections, and a thorough understanding of DSCR requirements.

Turn Your Real Estate Goals into Reality with Bluestone’s Flexible Financing

If you’re looking to seize investment opportunities in real estate, Bluestone Commercial Loans offers tailored solutions with our Bridge Loans and Fix-and-Flip Loans:

- Bridge Loans: Perfect for time-sensitive deals, giving you fast access to capital while awaiting permanent financing or property sale.

- Fix-and-Flip Loans: Ideal for real estate investors looking to purchase, renovate, and resell properties quickly. These loans cover property acquisition, rehab costs, and associated expenses.

- Fast, flexible financing with competitive rates.

- Streamlined application process with minimal paperwork.

- Dedicated loan specialists to guide you from start to finish.

Partner with Bluestone today and make your real estate investment goals a reality with our quick, reliable loan solutions!

Can we include a source here?

Added