Securing financing for commercial real estate can be complex and time-consuming, especially when conventional loans heavily emphasize personal credit history. This can create significant barriers to obtaining funding for investors with income-generating properties but weaker personal finances.

Debt Service Coverage Ratio (DSCR) loans offer a solution by focusing on the property’s cash flow. This makes DSCR loans an attractive option for commercial real estate investors looking to use the income potential of their properties to secure financing.

In this blog, we’ll discuss everything you need to know about DSCR loans, how they work, their requirements, and the benefits they offer to commercial real estate investors.

What Is a Debt Service Coverage Ratio Loan?

| A Debt Service Coverage Ratio (DSCR) loan is a type of financing primarily used in commercial real estate. It’s a unique loan structure where the lender evaluates a borrower’s ability to repay the loan based on their income relative to the debt obligations. |

In simpler terms, the DSCR helps lenders determine if the property generates enough income to cover the debt payments associated with a property or business.

How Does a DSCR Loan Work?

The process begins when a borrower applies for a loan to purchase or refinance a commercial property. Lenders assess the property’s cash flow, which includes rental income, profits from operating the property, and other revenue streams. They then compare this income to the property’s debt obligations, including principal, interest, taxes, and insurance.

The formula for calculating DSCR is simple:

Where:

Net Operating Income (NOI): The income generated from the property after operating expenses but before accounting for taxes and interest.

Total Debt Service: The total loan payments owed, including interest and principal.

| DSCR Range | Implication | Risk Level | Meaning |

| DSCR > 1.0

|

Property generates more income than needed to cover debt payments.

|

Low Risk

|

Indicates the property is profitable and can comfortably meet debt obligations.

|

| DSCR < 1.0

|

Property generates insufficient income to cover debt payments.

|

High Risk | Suggests the property may struggle to meet loan payments, increasing default risk.

|

| DSCR ≥ 1.25 (Favorable)

|

A strong indication of income generation and financial stability.

|

Very Low Risk

|

Typically required by lenders for loan approval. Criteria may vary by lender or property type.

|

For example, if the NOI is $120,000 and the total debt service is $100,000, the DSCR is 1.2, meaning the property generates 20% more income than the debt payments require.

What Are the Documents Required for a DSCR Loan?

DSCR loans have more straightforward documentation requirements than regular loans. While these loans generally involve less paperwork, it’s important to clarify that they are not “no-doc” loans. The term “no-doc” originated in the early 2000s, when some lenders allowed minimal documentation, contributing to the housing market crash and subsequent recession.

The main advantage of DSCR loans is their simplified documentation process and responsible underwriting. Lenders focus on essential documents, making it easier for borrowers to qualify without the heavy paperwork required for conventional loans.

Documentation Requirements

Application: A basic loan application includes primary details about the borrower and the property. It typically takes only 15 minutes and is a few pages long.

Credit Authorization: A brief authorization form allowing the lender to check the borrower’s credit report and background.

Bank Statements: Two months of bank statements to verify that the borrower has 3-6 months of liquid reserves to cover debt payments in the event of vacancy, turnover, or other disruptions.

Leases: The lease or leases must be submitted if the property is currently occupied for long-term rentals.

Short-Term Rental History: If the property operates as a short-term rental (e.g., Airbnb), the borrower must provide 12 months of operating history, often accessible through the booking platform or property manager.

Insurance: Proof of property insurance with the lender’s information included. Flood insurance will also be required if the property is located in a designated flood zone. While most DSCR lenders recommend liability insurance, it is usually not a mandatory document.

Entity Documents: These are required if the borrower applies through an LLC rather than as an individual. Standard documents requested by DSCR lenders include certificates of good standing, certificates of formation, and articles of organization and operating agreement.

What Are the Main Benefits of DSCR Loans for Real Estate Investors?

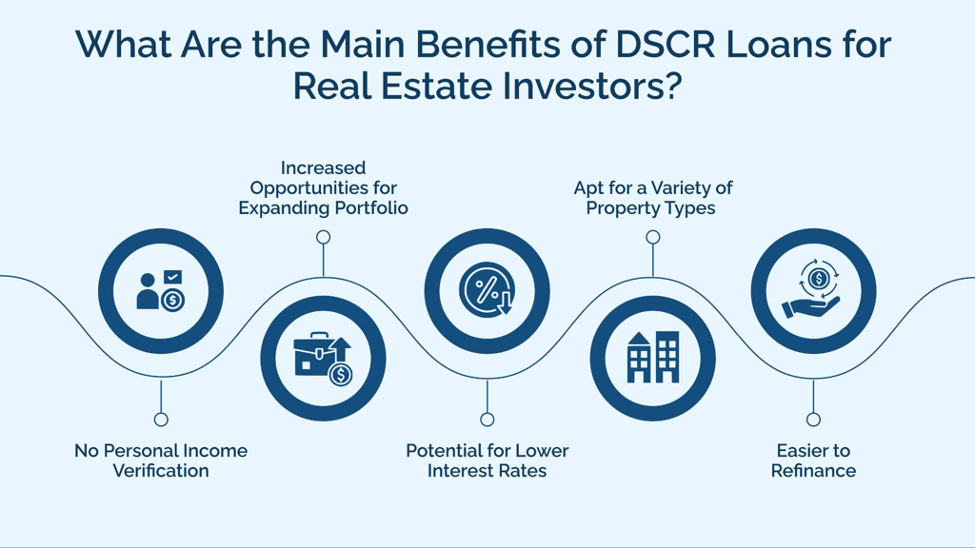

DSCR loans offer a variety of advantages for real estate investors looking to optimize their financing strategies. These loans keep the investors in mind, providing flexibility and fewer constraints than regular loan options. Here’s why they stand out:

No Personal Income Verification

Unlike conventional loans, which require extensive personal financial documentation, DSCR loans do not require proof of personal income. This benefits real estate investors with significant assets but may not show high personal income on paper. It allows them to access funding based on the revenue generated by the property itself.

Increased Opportunities for Expanding Portfolio

Since DSCR loans are based on the property’s cash flow, investors can qualify for larger loans without raising their debt burden. This approach enables investors to rapidly expand their portfolios by acquiring additional properties, significantly enhancing their long-term returns.

Potential for Lower Interest Rates

Since DSCR loans are used for cash-flowing properties and carry less risk for the lender, they often come with competitive interest rates. This can help investors save on long-term borrowing costs, maximizing their returns on investment.

Apt for a Variety of Property Types

DSCR loans are not limited to residential properties—they can be used for a wide range of real estate investments, including multi-family buildings, commercial properties, and even vacation rentals. This flexibility allows investors to diversify their portfolios and tap into various real estate markets.

Easier to Refinance

DSCR loans can be ideal for investors looking to refinance their properties. Since the focus is on the property’s income potential, investors can often refinance with favorable terms even if their income is limited or fluctuating. This simplifies accessing property equity and reinvesting it into new opportunities.

Are DSCR Loans Fixed or Variable Rate?

DSCR loans can have either a fixed or variable interest rate. While most are structured with a fixed interest rate, some lenders offer both options, allowing investors to choose based on their preferences and financial strategies.

DSCR loans usually have 30-year terms, and many offer a fixed rate for the entire duration. This stabilizes real estate investors, as the interest rate and debt payment remain consistent, allowing for more predictable cash flow.

This fixed-rate feature is especially advantageous for long-term investors, as it offers security. With rents in the U.S. increasing by 8.85% annually since 1980, investors can benefit from growing rental income while their debt payments stay the same. This makes fixed-rate DSCR loans appealing for those holding properties for extended periods.

However, there are also DSCR loan options with adjustable rates. These are called Adjustable-Rate Mortgages (ARMs), sometimes called Hybrid ARMs. Hybrid ARMs usually start with a fixed rate for an initial period before periodically changing it.

Types of Properties Eligible for DSCR Loans

DSCR loans are used for business purposes and residential properties. While the property must be residential, it should be rented out to generate income rather than owner-occupied.

Properties with a “Mixed Use” designation also qualify for DSCR loans, especially in urban areas. These may include buildings with businesses on the ground floor (e.g., offices or restaurants) and residential units above, as long as most of the space is residential.

However, certain property types are generally ineligible for DSCR Loans, including:

Agricultural Properties: Farms, ranches, and properties with agricultural income-producing activities are typically excluded.

Assisted Living Facilities: Properties for elder care are not eligible due to high turnover.

Single Room Occupancy Properties: While increasingly popular for maximizing rental income, these properties are generally ineligible unless easily convertible to single-unit occupancy.

Log Homes: True vacation cabins, especially in rural areas, are generally not eligible, though log-style homes with modern infrastructure may qualify.

Get Fast, Flexible Financing with Bluestone Commercial Capital

If you’re looking to seize investment opportunities in the real estate market, Bluestone Commercial Capital offers tailored solutions with our bridge loans and fix-and-flip loans:

- Bridge Loans: Perfect for time-sensitive deals, providing fast access to capital to secure and close transactions while awaiting permanent financing or property sale.

- Fix-and-Flip Loans: Ideal for real estate investors looking to purchase, renovate, and resell properties quickly. These loans cover property acquisition, rehab costs, and associated expenses.

- Fast, flexible financing options with competitive rates.

- Streamlined application process with minimal paperwork.

- Dedicated loan specialists to guide you from start to finish.

Partner with Bluestone today and turn your real estate investment goals into reality with our quick and reliable loan solutions.