Commercial real estate borrowing is projected to reach $578 billion in 2025, according to the Mortgage Bankers Association, a 16% increase over 2024’s volume of $498 billion. After sharp declines in 2023 and a modest rebound last year, this growth signals renewed investor activity, but also raises strategic questions about financing.

That volume has left many investors wondering: Should I opt for traditional CRE financing, or is a bridge loan better suited for my project?

The answer depends on what you’re trying to achieve. Are you racing to close on a value-add property before another buyer swoops in? Or are you purchasing a fully leased asset to hold for a decade or more?

This blog will break down the differences between bridge loans and traditional commercial real estate loans, exploring how each works, what makes them unique, and when one might serve your goals better than the other.

What Is a Bridge Loan?

| A bridge loan is a type of short-term financing used by businesses and real estate investors to cover immediate funding needs, typically lasting 6 months to 3 years, until longer-term financing or a property sale can be secured |

These loans are used by investors and developers who require rapid access to capital in time-sensitive situations, such as acquiring a distressed property, renovating a building, or securing a deal before long-term financing becomes available.

In commercial real estate, bridge loans are particularly popular for:

- Value-add acquisitions where immediate renovations or repositioning are needed

- Lease-up strategies for properties not yet stabilized

- Fast-closing purchases where traditional lenders can’t meet the deadline

- Refinancing scenarios involving balloon payments or expiring loans

Application and Approval Process

Bridge loans focus more on the asset’s value and less on the borrower’s income or credit profile. The approval process is generally faster, often within 5 to 10 business days.

Lenders assess:

- The current and future value of the property (after rehab, if applicable)

- The borrower’s experience with similar projects

- Exit strategy (e.g., sale, refinance, or lease-up)

- Down payment or equity in the property

Loan Terms and Funding

Bridge loans last between 6 and 24 months, often with interest-only payments during the term. Because they’re considered higher-risk, rates tend to be higher than those of conventional CRE loans, ranging from 9% to 12%, depending on the lender and deal structure.

Most bridge loans include:

- Interest-only monthly payments

- Balloon payment due at the end of the term

- Flexible draw schedules for rehab or construction

Repayment

Repayment comes through one of the following:

- Refinancing into a long-term commercial loan once the property stabilizes

- Selling the property after increasing its value

- Using proceeds from another asset sale

Because bridge loans are short-term, having a clear and viable exit strategy is crucial to avoid default or costly extensions. For investors managing fast-moving deals or transitional properties, bridge loans offer the speed and adaptability that traditional loans often can’t match.

What Are CRE Loans?

A traditional commercial real estate (CRE) loan is a long-term financing solution used to purchase or refinance stabilized, income-producing properties, such as office buildings, multifamily housing, retail centers, industrial assets, and warehouses.

A traditional CRE home loan is structured for stability. They’re ideal for fully leased, cash-flowing properties where the investor plans to hold the asset for the long term. Due to their lower risk profile, these loans are associated with more favorable CRE loan rates, which vary depending on the lender and market conditions.

In commercial real estate, traditional CRE financing is used for:

- Acquiring fully leased, income-generating properties

- Refinancing existing debt on stabilized assets

- Long-term ownership strategies focused on steady ROI

- Portfolio expansion through low-risk, amortized financing

Application and Approval Process

Unlike bridge loans, traditional CRE loans are underwritten primarily based on the borrower’s financial profile and the property’s income performance. Approval can take 30 to 90 days, depending on the lender and the complexity of the deal.

Lenders evaluate:

- Borrower creditworthiness and financial statements

- Property cash flow and operating history

- Debt Service Coverage Ratio (DSCR)

- Loan-to-Value (LTV) ratio, typically 65% to 80%

- Lease agreements and tenant quality (for rental assets)

Loan Terms and Funding

CRE loans typically have terms ranging from 5 to 30 years and offer both fixed and variable interest rates, depending on market conditions and the lender’s type. These loans are commonly amortized, meaning borrowers make consistent monthly payments that include both principal and interest.

Most traditional CRE loans include:

- Fixed or adjustable interest rates (usually 5%–7%)

- Amortization schedules aligned with the loan term

- Prepayment penalties, depending on the agreement

- Lower rates than bridge loans due to lower perceived risk

Lenders offering traditional CRE financing include:

- Banks and credit unions

- Life insurance companies

- CMBS (Commercial Mortgage-Backed Securities) lenders

- Agency lenders (e.g., Freddie Mac or Fannie Mae for multifamily)

Repayment

Repayment is straightforward: borrowers make regular monthly payments until the loan matures. Since these loans aim for long-term ownership, there’s no large final payment due at the end.

Borrowers repay through:

- Property-generated rental income

- Business income (if owner-occupied)

- Eventual sale or refinance (at end of term or to access equity)

Traditional CRE financing provides the long-term stability many investors need, but it requires more documentation, longer timelines, and a strong property performance history to qualify.

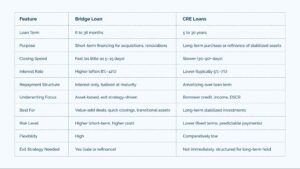

Bridge Loan vs. CRE Loans: Side By Side Comparison

Pros and Cons of Bridge Loans vs. Traditional CRE Loans

Bridge loans and traditional CRE financing loans have their place in a real estate investor’s planning. Choosing between them depends on your investment timeline, property type, and risk tolerance.

Here’s a breakdown of the pros and cons of each to help clarify which path aligns best with your goals.

Bridge Loans

| Pros | Cons |

| Fast funding; ideal for time-sensitive acquisitions | Higher bridge loan interest rates and fees |

| Flexible underwriting focused on asset value and future potential | Short repayment period with balloon payment due at maturity |

| Suitable for properties that aren’t yet stabilized or cash-flowing | Requires a strong and viable exit strategy |

| Great for short-term repositioning or renovation projects | Less favorable terms for less experienced borrowers |

Traditional CRE Loans

| Pros | Cons |

| Lower interest rates and long-term cost | Slower approval and funding process |

| Predictable amortization schedules | Stricter underwriting based on credit, income, and DSCR |

| Designed for stabilized, income-producing properties | Less flexibility in structure and use of funds |

| Ideal for long-term hold and portfolio growth | Not suitable for distressed or value-add properties needing quick action |

Secure the Capital You Need On Your Terms from Bluestone Capital

Choosing between a bridge loan and a traditional CRE loan doesn’t have to be overwhelming, especially when you have a financing partner who understands your goals. At Bluestone Commercial Capital, we offer tailored lending solutions designed to match your investment timeline, project type, and risk profile.

Here’s how Bluestone can help:

- Fast approvals and closings for time-sensitive acquisitions

- Flexible bridge financing options for transitional or value-add properties

- Competitive rates and terms for long-term CRE loans

- Expert guidance to help you align financing with your business strategy

Let’s talk about which financing solution fits your next project best. Receive a customized quote and explore your commercial lending options with confidence.