Did you know that investors now account for nearly 1 in 4 home purchases in the U.S., one of the highest shares in the past decade?

DSCR loans enable you to qualify based on a property’s income, not your income, making them a powerful method for growing your rental portfolio. However, there’s a catch: most DSCR loan requirements structure the deal through a Limited Liability Company (LLC) or another business entity.

In this blog, we’ll break down what a DSCR loan is, why lenders prefer LLCs, how to set up your LLC, what documents are needed, and how to navigate multi-member structures and credit reviews.

What is a DSCR Loan?

A DSCR loan, short for Debt Service Coverage Ratio loan, is a type of real estate loan specifically created for income-generating properties, such as rentals and commercial buildings. It differs from regular mortgages in one significant way: the borrower’s income isn’t the primary factor.

Instead, the loan hinges on the property’s ability to generate enough income to cover its monthly debt payments. This is measured using the DSCR, or Debt Service Coverage Ratio:

| DSCR = Net Operating Income (NOI) / Debt Obligations (PITIA) (Principal + Interest + Taxes + Insurance + HOA, if applicable) |

For example, if a property brings in $2,000/month in rent and the monthly loan cost is $1,500, the DSCR is 1.33. That means the property generates 33% more than what’s needed to pay the debt.

Most lenders require a DSCR of 1.0 to 1.25, depending on their risk profile.

Why DSCR Loans Are Ideal for Rental and Commercial Properties

Now that you understand the DSCR loan meaning, let’s explore why this financing model is popular with investors:

- No W-2s or tax returns required: Qualification is based on rental income, not your job or self-employment earnings.

- Faster scaling: You can expand your portfolio without hitting personal debt-to-income (DTI) limits.

- Flexible property types: You can use a DSCR loan for commercial property, short-term rentals, long-term rentals, or mixed-use spaces.

- More favorable underwriting: Lenders focus on numbers rather than narratives.

If your investment property generates income, you can secure financing, regardless of your personal income level.

Why Lenders Prefer DSCR Loans for LLC-Owned Properties

If you’re applying for a DSCR loan with LLC ownership, you’re aligning with lender expectations. These loans are classified as business-purpose financing, meaning they’re suitable for commercial use, not personal residences.

As a result, lenders often require the borrowing entity to be an LLC or a corporation. Holding the property in your name can result in immediate denial.

Here’s why the DSCR loan for LLC property model is preferred:

- Legal separation between business and personal assets

- Asset protection in the event of lawsuits or default

- Tax advantages through pass-through income

- Easier scalability with multiple properties held under one or more LLCs

- Cleaner underwriting, without mingling personal financials

Even though the LLC holds the loan, most lenders still require a personal guarantee from the majority owners (those owning 51% or more). This ensures accountability while preserving the structure of a business loan.

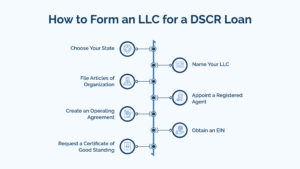

How to Form an LLC for a DSCR Loan

Forming an LLC is a relatively simple and affordable process. Here’s how to form one, specifically for a DSCR loan for commercial property or rental investment:

Choose Your State: Form the LLC in the property’s state. If it’s out of state, you’ll also need to register as a foreign entity.

Name Your LLC: Make it unique and compliant. Most states require the name to include “LLC.”

File Articles of Organization: Submit this online with your Secretary of State. Fees range from $50 to $300.

Appoint a Registered Agent: This is the person or company responsible for receiving and forwarding legal notices.

Create an Operating Agreement: Lenders often require this document. It outlines ownership, roles, and profit distribution. Consider seeking counsel to review your document.

Obtain an EIN: Your Employer Identification Number (EIN) is similar to a Social Security Number for your business. Apply free at IRS.gov.

Request a Certificate of Good Standing (if needed): This document confirms that your LLC is up-to-date with state filings, particularly if it has been inactive for over a year.

Once these steps are complete, you’re ready to use your LLC as the borrowing entity for a DSCR loan.

DSCR Loan Requirements and Documentation Checklist

Once your LLC is established, the next step is preparing your documentation. DSCR lenders have a relatively standardized set of requirements, but submitting complete and accurate paperwork is essential to keep the process moving quickly. Most documents fall into three categories: LLC documentation, guarantor documentation, and property documentation.

Here’s a breakdown of what lenders expect:

1. LLC Documentation

Lenders need to verify the legal structure and standing of your business entity. Be ready to provide:

- Articles of Organization: This is your LLC’s formation certificate issued by the state.

- Operating Agreement: A signed agreement outlining ownership percentages, management roles, and operational procedures.

- EIN Letter or IRS Form W-9: Confirms your LLC’s tax identification number.

- Certificate of Good Standing: Required if your LLC is more than one year old or operating across state lines.

- Foreign Entity Registration: Needed if your LLC is formed in a different state than where the property is located.

2. Guarantor Documentation

Although the LLC is the official borrower, most lenders require a personal guarantor. The individual(s) must submit:

- Government-Issued ID: Driver’s license or passport to verify identity.

- Credit Report: A soft pull is often sufficient; lenders use this to evaluate risk and set terms.

- Background Check: Screens for past financial or legal issues.

- Proof of Liquidity: Typically, the two most recent personal bank statements.

- Experience Summary: A list of previously completed rental or investment projects (if applicable).

3. Property Documentation

Since DSCR loans are based on the property’s income potential, thorough documentation of the asset is essential:

- Purchase Contract: If you’re acquiring a new property.

- Current Lease Agreements: If the property is already rented.

- Appraisal Report: Confirms the market value and rental income assumptions.

- Property Insurance: Proof of hazard insurance and flood insurance, if required.

- Title Documents: Includes title commitment, preliminary report, and HOA disclosures if applicable.

Properly organizing these documents can significantly speed up your loan approval.

DSCR Loan Qualification Process: Step-by-Step

Here’s how to qualify for a DSCR loan, once your documents are ready:

Step 1: Submit Your Package

Send all LLC, property, and personal documents in one go to avoid bottlenecks.

Step 2: Appraisal & Rent Analysis

The lender orders an appraisal and evaluates market rents to calculate your DSCR.

Step 3: DSCR Calculation

They apply the formula: Gross Monthly Rent / PITIA. A DSCR of 1.25 or higher is ideal.

Step 4: Credit Review

Even though your income isn’t reviewed, your credit score affects DSCR loan rates and loan terms.

Step 5: Approval & Closing

Once all checks are complete, you’ll sign the closing documents and receive funding, typically within 2–3 weeks.

Multi-Member LLCs: What You Should Know

When your LLC has multiple members, understanding how credit scores and ownership percentages influence DSCR loan approval is critical. Although the loan is issued to the LLC, lenders require personal guarantees from individuals who collectively own at least 51% of the company. This means the credit profiles of these guarantors directly affect your loan terms.

Credit Score Impact

Lenders typically evaluate the credit scores of all guarantors who meet the 51% ownership threshold. However, the member with the lowest credit score often determines the loan’s interest rate, maximum loan-to-value (LTV), and overall eligibility. For instance, if one guarantor’s credit score is significantly lower than the others, it could limit your borrowing power or increase your loan costs.

Ownership Structure

How ownership is divided can make a big difference. If you can structure your LLC so that members hold at least 51% ownership with firm credit profiles, you may qualify for better rates and higher LTVs. Conversely, a more evenly split ownership between members with varying credit qualities can complicate underwriting and potentially lead to less favorable terms.

Primary Considerations for Multi-Member LLCs:

- Ensure guarantors who hold majority ownership have strong credit scores (ideally 680 or higher).

- Consider reorganizing ownership percentages to give majority control to high-credit members before applying.

- Be aware that credit issues such as recent bankruptcies, delinquencies, or late payments may increase reserve requirements or result in denial.

Managing these factors proactively can improve your chances of DSCR loan approval and secure more advantageous financing terms.

Also Read: Why Are DSCR Loans Ideal for Multifamily Real Estate Investments

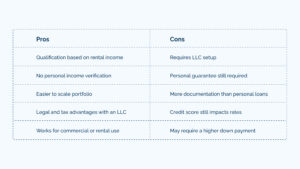

DSCR Loan Pros and Cons

Before you commit, consider these pros and cons:

Secure Financing for Your LLC-Owned Property Quickly With Bluestone

Bluestone Commercial Capital is here to make your DSCR loan process smooth and straightforward. Whether you’re forming an LLC or already have one, our expert team provides fast approvals, competitive rates, and personalized support to help you grow your real estate portfolio confidently.

Why Choose Bluestone Commercial Capital?

- Quick loan approvals (2-3 weeks!) with minimal paperwork

- Competitive rates tailored for LLC borrowers

- Guidance on LLC formation and documentation

- Flexible terms that fit your investment goals

- Dedicated support from application to funding

Take the next step toward smart commercial real estate investing.

Contact Bluestone today and get the financing you need with confidence.