Securing financing for commercial real estate can feel like a race against time. Investors often find the perfect property, ready for redevelopment or poised to generate rental income, but lose out because conventional lenders take too long to process their applications. Waiting weeks (or months) for approvals can kill deals in competitive markets where timing is everything.

This is where commercial property bridge financing comes in. These short-term, asset-backed loans are designed for speed and flexibility, enabling investors to act decisively when opportunities arise.

Bridge loan volumes in the U.S. surged 51% year-over-year in January 2025, reflecting strong investor demand for faster, more adaptable funding options. The numbers demonstrate the significant momentum this strategy is gaining.

In this blog, we’ll discuss what makes commercial bridge loans work, especially for those financing commercial properties, along with who they’re best for, how rates are structured, and what risks to manage along the way.

What Is a Commercial Property Bridge Loan?

| A commercial property bridge loan is a short-term financing solution that “bridges” the gap between the immediate need for capital and the eventual availability of long-term funding. |

These loans are most commonly used by real estate investors, developers, and business owners who need to act quickly, whether they’re purchasing a new property, renovating an existing one, or waiting for a traditional loan to finalize.

Commercial property bridge financing is built for speed. Funds are usually available within days of approval, making it ideal for time-sensitive situations such as auction buys, short-sale opportunities, or refinancing under pressure. These loans are usually secured by the property itself and based more on asset value and exit strategy than on borrower income or credit score alone.

Terms for bridge loans usually range from 6 to 24 months, and repayment may be structured as interest-only until the property is sold, refinanced, or stabilized. Because of their flexibility, bridge loans are often considered a strategic tool for real estate professionals looking to capitalize on short-term opportunities without being held back by lengthy approval processes or rigid lending requirements.

Why Does Flexibility Matter in Bridge Financing?

In commercial real estate, deals move fast, and the financing needs to move even faster. Conventional lenders often impose rigid conditions, long approval timelines, and cookie-cutter terms that don’t align with the unique challenges investors face on the ground. This is where flexible commercial property bridge financing proves invaluable.

A flexible bridge loan can adapt to changing project timelines, shifting market conditions, or unexpected costs that pop up during renovations or repositioning. For developers juggling construction delays or investors working to stabilize a newly acquired asset, having room to breathe, without penalties or red tape, can make or break the investment.

Here’s what flexibility can look like in practice:

- Customized repayment schedules: Interest-only payments, balloon structures, or extension options based on your exit plan

- Adjustable draw schedules: Funds released in phases aligned with renovation milestones or leasing progress

- Tailored loan durations: Shorter terms with built-in extensions to accommodate changing timelines

Features of a Commercial Bridging Loan for Property Development

A commercial bridging loan for property development has its pros and cons. It is purpose-built to meet the urgent, short-term financing needs of investors and developers. These loans aim to provide fast access to capital for purchasing land, redeveloping existing commercial spaces, or completing construction before transitioning to long-term financing.

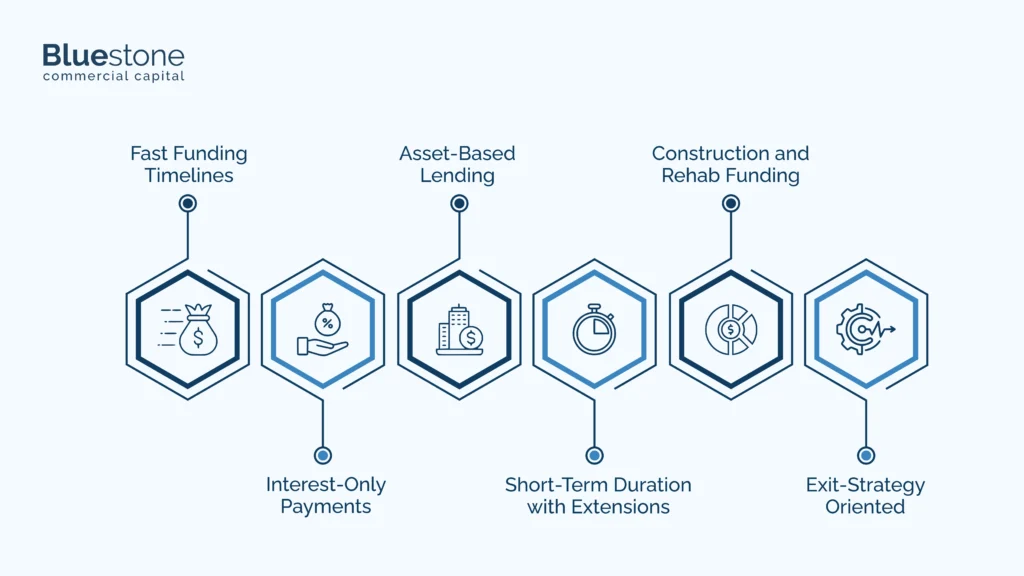

Here are some standout features that make these loans so effective for development projects:

Fast Funding Timelines

Speed is one of the biggest advantages. Many lenders can approve and fund a commercial bridge loan in as little as 5 to 14 days, allowing developers to act quickly on high-potential opportunities or secure assets under tight deadlines.

Interest-Only Payments

Most bridge loans offer interest-only payment structures during the loan term, which can help preserve cash flow during the build-out or renovation phase of a project.

Asset-Based Lending

Unlike regular loans, which rely heavily on the borrower’s credit profile and income, bridge loans are typically collateral-based. This means the property (or future value of the completed project) is the main factor in underwriting.

Short-Term Duration with Extensions

Loan terms usually range from 6 to 24 months, depending on the scope of the development. Many lenders also offer extensions if the project takes longer than expected, provided that progress milestones are met.

Construction and Rehab Funding

In development scenarios, bridge loans often include staged funding (or draw schedules) to cover renovation or construction costs. Funds are released in phases as work is completed and verified.

Exit-Strategy Oriented

Bridge lenders focus on how the borrower plans to repay the loan, whether through a property sale or long-term refinance. A well-defined exit plan is critical for loan approval.

Who Should Consider Bridge Loans for Commercial Properties

Commercial property bridge loans provide access to capital quickly, often within days, making them ideal for investors and developers who need to act fast.

A bridge loan is especially well-suited for borrowers in the following situations:

- Real estate investors aiming to acquire properties before long-term financing is secured

- Developers needing immediate capital to begin or complete construction projects

- Business owners transitioning between two commercial spaces

- Borrowers looking to refinance a maturing loan while securing better terms

- Investors repositioning underperforming assets to increase value and attract tenants

- Self-employed borrowers or those with non-traditional income streams

In short, anyone facing a funding gap between acquisition and refinance, construction and stabilization, or sale and purchase should explore how bridging loans for commercial properties can provide much-needed flexibility.

How to Qualify for a Flexible Commercial Bridge Loan

Qualifying for a flexible commercial bridge loan is more straightforward than regular financing because lenders focus primarily on the value of your collateral and your exit plan. Most lenders look for a few key qualifications to ensure the loan can be repaid smoothly and on time.

Generally, you’ll need to provide:

- Collateral: Sufficient equity in the property or other assets to secure the loan

- Ownership Documentation: Proof that you legally own the collateral being used

- Payment Ability: Demonstration that you can cover interest payments during the loan term

- Repayment Plan: A clear and realistic strategy for repaying the loan, such as selling the property or refinancing

To improve your chances of approval, keep these tips in mind:

- Confirm the lender’s equity requirements and ensure your collateral meets their thresholds for financing a commercial property

- Review your credit score, as a stronger credit score can lead to more favorable terms

- Shop around by comparing offers from different lenders to find competitive commercial property finance rates

- Factor in all fees and costs to understand the total repayment obligation

- Prepare and submit all necessary paperwork promptly to avoid delays

- Complete any required inspections or appraisals quickly to speed up underwriting

With a solid equity position and a well-defined exit strategy, obtaining commercial property financing options can be a smooth process, often resulting in funding within days or weeks. This makes it an ideal choice for investors seeking to act quickly without compromising financial prudence.

Comparing Bridge Loans with Other Commercial Property Financing Options

When exploring financing options for commercial real estate, it’s essential to understand how bridge loans differ from traditional lending methods and how alternatives, such as seller-financing commercial property, fit into the picture.

Bridge loans provide short-term, flexible solutions that quickly bridge funding gaps, whereas regular loans often involve longer approval times, stricter requirements, and fixed terms.

Here’s a comparison to help clarify the distinctions:

| Feature | Bridge Loans | Traditional Loans | Seller Financing Commercial Property |

| Loan Term | Short-term (6–24 months) | Long-term (5–30 years) | Varies based on agreement |

| Approval Speed | Fast (days to weeks) | Slow (weeks to months) | Negotiable, often faster than banks |

| Qualification Focus | Collateral value and exit strategy | Borrower creditworthiness and income | Flexible, depends on seller’s criteria |

| Interest Rates | Higher | Lower | Lower |

| Repayment Structure | Interest-only or balloon payments | Amortized payments | Flexible |

| Use Cases | Quick acquisition, renovations, refinancing | Purchase, refinancing, long-term ownership | Financing when traditional loans aren’t accessible |

| Flexibility | High, customizable terms | Less flexible, fixed schedules | Highly flexible and personalized |

Understanding these differences can help investors and business owners choose the right financing path, whether they need the speed and adaptability of a bridge loan, the stability of traditional financing, or the personalized approach of seller financing for commercial property.

Partner with Bluestone Commercial Capital for Your Bridge Financing Needs

Bluestone Commercial Capital is your trusted partner for flexible, fast, and reliable commercial property bridge financing. We understand the urgency and complexity of commercial real estate deals and tailor our solutions to fit your unique project requirements. Whether you’re a developer, investor, or business owner, Bluestone provides the support and expertise to help you secure the funding you need, when you need it.

Here’s how Bluestone can help you succeed:

- Fast Approvals & Funding: Get capital quickly to seize time-sensitive opportunities

- Flexible Loan Terms: Customized solutions designed around your project timeline and goals

- Competitive Rates: Transparent pricing to maximize your investment returns

- Expert Guidance: Dedicated support from experienced professionals throughout the process

- Streamlined Process: Simple documentation and clear communication from application to closing

Reach out to Bluestone Commercial Capital today and discover how our bridge loans can keep your commercial property projects moving forward with confidence.