When deals are only about numbers, they become fragile, easily lost to the next lower rate, the next smoother process, or the next lender promising the world. But what if the relationship wasn’t just transactional? What if it was built on something more profound—trust, reliability, and a shared commitment to getting deals done right?

The best partnerships in this industry aren’t built on price alone. They’re built on a good relationship. Did you know that acquiring a new customer can cost up to five to twenty-five times more than retaining an existing one? This statistic highlights the importance of cultivating trust and understanding in business partnerships.

Brokers and lenders who prioritize relationships over fleeting deals aren’t just surviving in the market. They’re thriving.So, are you treating this relationship like a transaction or a long-term strategy?

The Role of Trust and Communication

When we talk about broker-lender dynamics, trust and communication determine the longevity of the partnership itself. A lender that views brokers as replaceable intermediaries will struggle to build loyalty, just as a broker who sees lenders as mere rate providers may find themselves constantly chasing better deals. The reality is that strong relationships drive better deals—not just through pricing but through reliability, consistency, and problem-solving.

Trust is built through experience. When brokers know they can rely on a lender to deliver on time and resolve challenges efficiently, they are far more likely to choose them over a competitor offering a slightly better rate. A lender that invests in its broker relationships through transparency, responsiveness, and follow-through becomes the go-to choice—even in a fluctuating market.

But trust doesn’t exist without communication. One of the biggest frustrations brokers face is last-minute surprises—loan delays, sudden documentation requests, or shifting underwriting standards. The deeper the relationship, the more predictable and seamless the process becomes. When lenders take the time to collect broker feedback, set clear expectations, and maintain open dialogue, they minimize uncertainty and create a partnership built on confidence.

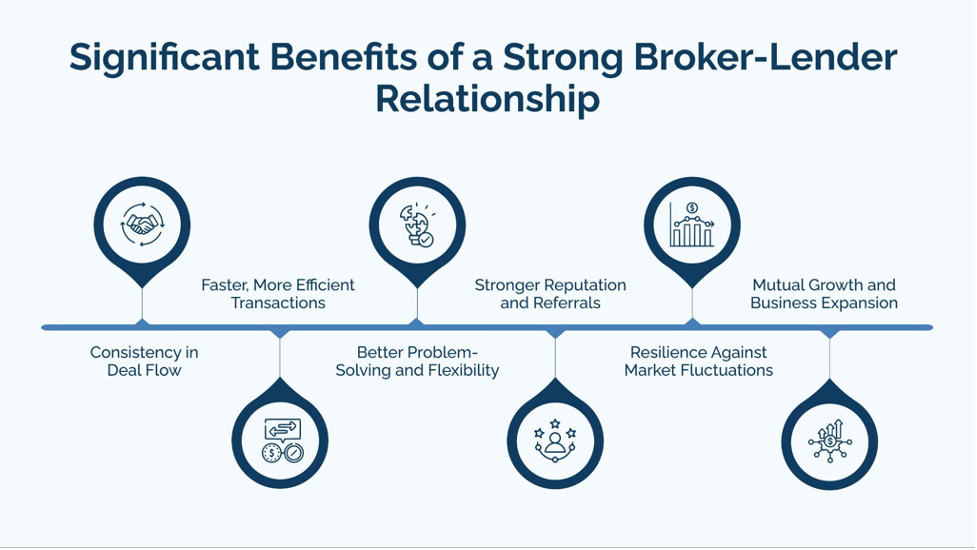

Significant Benefits of a Strong Broker-Lender Relationship

A transactional mindset in the broker-lender space leads to short-term gains but long-term instability. A partnership builds resilience in a fluctuating market and creates opportunities beyond pricing. Here’s why investing in strong broker-lender relationships pays off:

1. Consistency in Deal Flow

Brokers with strong lender relationships don’t constantly shop around for new partners. Instead of prioritizing the lowest rate, they focus on reliability—working with lenders who consistently deliver on time, communicate clearly, and ensure a smooth process. This means:

- More predictable closings, reducing uncertainty in revenue streams.

- More substantial borrower confidence, knowing deals won’t fall apart due to lender inefficiencies.

2. Faster, More Efficient Transactions

When brokers and lenders understand each other’s workflows, unnecessary delays disappear. A broker familiar with a lender’s underwriting preferences can submit complete files from the start, reducing last-minute document requests and keeping transactions on track.

With fewer inefficiencies, approvals happen faster, and borrowers can secure funding without unnecessary hold-ups.

3. Better Problem-Solving and Flexibility

Unexpected challenges are inevitable in lending—missing documents, complex underwriting scenarios, or last-minute borrower changes. A strong broker-lender relationship makes navigating these hurdles easier. Established trust allows lenders to grant exceptions when needed, while open communication ensures that both parties work toward solutions instead of hitting roadblocks.

When lenders see a broker as a long-term partner rather than just another deal source, they are more willing to find creative ways to make deals work.

4. Stronger Reputation and Referrals

A smooth loan experience benefits more than just the broker and lender—it builds borrower confidence. When deals close smoothly, borrowers:

- Refer more business, bringing in high-quality leads.

- Leave positive reviews, strengthening both broker and lender credibility.

5. Resilience Against Market Fluctuations

Market conditions shift constantly, including interest rates, lending guidelines, and economic trends, affecting deal flow. Brokers are often bombarded with offers from different lenders promising better rates. However, they tend to stick with lenders who provide reliable funding even when conditions tighten. Consistent service and a proven ability to close deals hold more weight than short-term pricing advantages, especially during economic uncertainty.

6. Mutual Growth and Business Expansion

Lenders who support their brokers through training, market insights, or lead-sharing—build partnerships that lead to sustained business growth. A broker valued by a lender is far more likely to send consistent business their way.

Strategies for Strengthening Broker-Lender Partnerships

A strong broker-lender relationship isn’t built overnight—it requires effort from both parties. Here’s how both sides can foster partnerships that go beyond transactional interactions:

Prioritizing Transparency and Responsiveness

Strong broker-lender relationships thrive on clear expectations and timely communication. Without these, deals stall, frustrations rise, and opportunities slip away.

Lenders should:

- Provide precise loan requirements and processing timelines.

- Set realistic underwriting expectations to avoid last-minute surprises.

Brokers should:

- Be upfront about borrower financials and potential challenges.

- Communicate expectations early to prevent unnecessary delays.

Responsiveness is just as critical. Slow replies and unclear updates lead to frustration. Lenders who provide proactive communication and quick turnaround times become brokers’ preferred partners. Likewise, brokers who deliver well-prepared applications help lenders streamline approvals.

Utilizing Feedback for Continuous Improvement

Feedback shapes a strong broker-lender partnership. Regular check-ins help identify pain points, inefficiencies, and growth opportunities.

Lenders should

- Conduct regular surveys to assess service quality.

- Address concerns promptly to build long-term relationships.

Brokers should

- Share insights on borrower experiences and lender efficiency.

- Provide constructive feedback to improve collaboration.

A lender who listens and adapts earns a broker’s trust and repeat business. A broker who communicates challenges helps create smoother, more predictable transactions. Feedback isn’t just a strategy. It’s essential for building lasting partnerships.

Offering Value Beyond Competitive Rates

While pricing is essential, brokers prioritize reliability, efficiency, and support. A lender offering more than just low rates becomes a preferred partner.

What brokers value:

- Consistent service with predictable underwriting and funding timelines.

- Reliable communication to prevent last-minute surprises.

- Technology tools that streamline the loan process.

Lenders can stand out by:

- Providing educational resources like training sessions or market insights.

- Offering dedicated support teams to handle broker inquiries.

- Investing in automation to reduce paperwork and delays.

A lender who simplifies the process and empowers brokers wins long-term loyalty. Brokers, in turn, send more business to lenders who make their jobs easier—not just those with the lowest rates.

Recognizing and Rewarding Loyalty

A strong broker-lender relationship thrives on mutual appreciation. Brokers who consistently bring quality business should feel valued beyond just transactional interactions.

Ways lenders can build loyalty:

- Preferred partnerships with faster approvals or dedicated account managers.

- Incentive programs that reward repeat business with better terms.

- Public recognition through testimonials, case studies, or networking events.

Beyond financial perks, a simple thank you or acknowledgment of a broker’s efforts strengthens trust. When brokers feel appreciated, they are more likely to prioritize lenders who invest in the relationship—not just the deal.

Strengthen Your Broker-Lender Connections for Better Deals

The right relationships lead to better opportunities, and that’s exactly what Bluestone Commercial Loans delivers. We don’t just provide funding; we build partnerships that help brokers and lenders close more deals faster and with confidence.

- Fast, Flexible Financing: Close in as little as two weeks to meet tight deadlines.

- Reliable Lending Solutions: Tailored options that fit unique borrower needs.

- Support Beyond Capital: Expertise, responsiveness, and a commitment to long-term success.

- Proven Track Record: Our extensive portfolio features a variety of high-quality, business-purpose loans secured by commercial real estate, ranging from modest amounts to multi-million-dollar investments.

Strong connections in the lending industry don’t just streamline transactions—they provide new growth opportunities. Let’s build a partnership that delivers accurate results.