Lenders are constantly swamped with loan applications—many of which are incomplete, missing critical documents, or backed by borrowers with little chance of approval. Sifting through these applications to find viable deals is a time-consuming challenge that slows the lending process.

This is where brokers make all the difference. Acting as a filter, they refine applications, verify financials, and ensure that only well-structured, high-quality deals reach the lender’s desk. By aligning borrowers with lenders who match their criteria, brokers eliminate inefficiencies, minimize risk, and accelerate approvals.

Brokers are invaluable for lenders looking to optimize their workflow and maximize profitability. They don’t just bring in deals—they bring in the right deals, turning the lending process into a smooth, efficient, and results-driven operation.

Broker vs. Direct Lender: A Strategic Comparison

Lenders who operate without brokers manage the entire loan process, from sourcing borrowers to underwriting and closing deals. This model offers complete control but requires strong in-house marketing, underwriting expertise, and borrower networks.

In contrast, working with brokers shifts the focus from lead generation to deal execution. Brokers act as strategic partners, vetting borrowers, structuring applications, and presenting only high-quality, pre-qualified deals. This reduces risk, saves time, and lets lenders focus on closing transactions rather than sourcing leads.

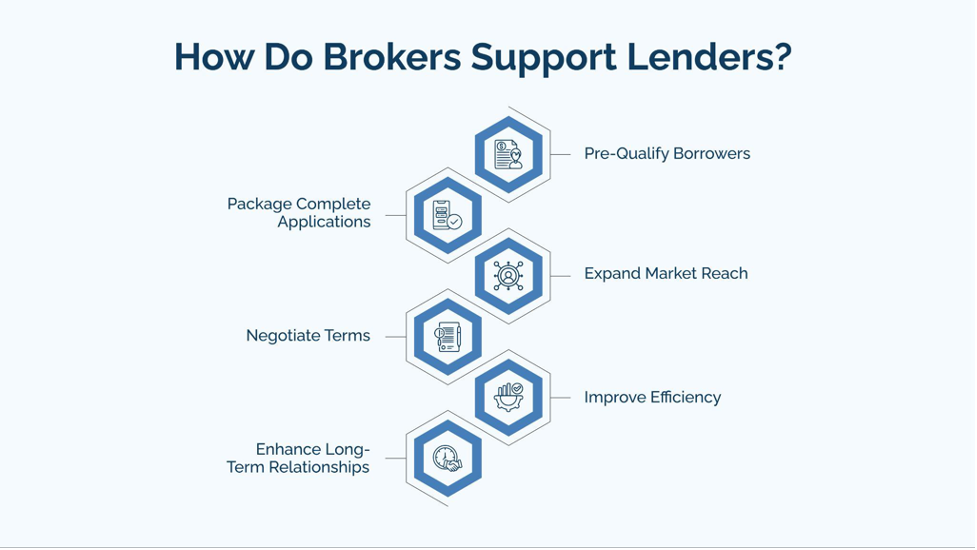

How Do Brokers Support Lenders?

Brokers, more specifically, mortgage brokers, are strategic partners who streamline the lending process and enhance deal quality. Their role extends beyond matching lenders with borrowers—they optimize efficiency, reduce risk, and drive higher conversion rates.

Pre-Qualify Borrowers – Brokers ensure applicants meet lender criteria before submission, reducing time spent on unqualified leads.

Package Complete Applications – They gather and organize financial documents, making underwriting smoother and faster.

Expand Market Reach – Brokers connect lenders with borrowers they wouldn’t reach through regular channels.

Negotiate Terms – They bridge gaps between borrower expectations and lender requirements, increasing approval rates.

Improve Efficiency – With a broker handling initial due diligence, lenders can focus on closing deals rather than chasing paperwork.

Enhance Long-Term Relationships – A strong broker network helps lenders maintain a steady pipeline of high-quality deals.

For lenders, working with brokers means fewer headaches, better deals, and a stronger bottom line.

How Do Brokers Expand a Lender’s Market Reach?

Commercial real estate brokers directly channel untapped borrower segments, helping lenders expand their market reach without costly marketing efforts. With established networks and industry insights, brokers connect lenders with qualified borrowers who may not have otherwise approached them. This access allows lenders to diversify their portfolios, serving borrowers across different industries, risk profiles, and financing needs.

Beyond just introductions, brokers also educate borrowers on lender-specific requirements, ensuring applications align with approval criteria. This reduces friction in the lending process and increases the likelihood of successful deals. By utilizing brokers, lenders can efficiently scale their operations and reach higher-quality borrowers ready to secure financing.

Ensuring Loan Quality and Reducing Risk

Brokers ensure loan quality and minimize risk for lenders. By conducting initial screenings, they filter out unqualified applicants so that only viable loan opportunities reach underwriting. This reduces wasted time and resources while improving approval rates.

Brokers help structure deals to align with lender requirements by verifying financials, assessing borrower credibility, and addressing compliance concerns before submission. This meticulous approach reduces defaults, enhances portfolio performance, and strengthens lender confidence in every transaction.

Streamlining the Loan Process

Brokers do more than connect lenders with borrowers—they expand a lender’s market reach by bringing in qualified clients who might not have considered certain financing options. With a deep understanding of different industries and borrower needs, brokers position lenders in front of the right audiences, ensuring a steady pipeline of opportunities.

By streamlining the loan process, brokers make it easier for lenders to approve deals quickly. They handle documentation, pre-screen borrowers, and structure applications to align with lender criteria. This reduces inefficiencies and allows lenders to focus on funding more deals, growing their portfolio, and reaching a broader market without having to use resources for direct client acquisition.

Negotiating Competitive Terms

Brokers are crucial in ensuring lenders remain competitive by negotiating loan terms that balance risk, profitability, and borrower appeal. Their deep understanding of market conditions allows them to craft financing solutions that align with lender guidelines and borrower expectations. Rather than a rigid, one-size-fits-all approach, brokers work to tailor deals that satisfy both parties, helping lenders close more loans without taking on excessive risk.

Expanding a lender’s market reach means attracting a diverse range of borrowers with varying financial profiles. They negotiate lower interest rates, adjusted repayment schedules, or reduced fees when necessary—all while ensuring lenders operate within profitable margins.

Significant ways brokers negotiate competitive terms:

- Customize loan structures to match borrower needs without increasing lender exposure.

- Utilize market insights to ensure rates and terms remain attractive.

- Minimize risk factors by addressing underwriting concerns upfront.

- Reduce processing inefficiencies to create a smoother lending experience.

- Encourage repeat business by fostering trust between borrowers and lenders.

This ability to structure favorable terms attracts more borrowers and encourages long-term relationships, keeping lenders ahead of competitors in an increasingly dynamic financial landscape.

The Pros and Cons of a Mortgage Broker

While mortgage brokers can provide valuable advantages for borrowers and lenders, they also come with inevitable trade-offs. Understanding the benefits and potential drawbacks helps lenders and borrowers make informed decisions about working with a broker.

| Pros | Cons |

| Access to more loan options | Additional broker fees |

| Faster loan approvals | Less direct control over terms |

| Expertise in complex deals | Potential conflicts of interest |

| Strong lender relationships | Varying levels of broker quality |

| Streamlined application process | Dependency on broker efficiency |

Close More High-Value Deals with Bluestone Commercial Loans

At Bluestone, our direct lending model, fast approvals, and transparent process ensure certainty of execution and a streamlined experience for borrowers.

Why Partner with Bluestone?

- Direct Access to Underwriting – Work directly with our in-house team for fast, reliable decisions.

- Speed Matters – Pre-approvals or term sheets within 24 hours, with closings in as little as 72 hours.

- Broker Protection – Transparent borrower fees and competitive broker compensation, paid post-closing.

- Low Fees, High Certainty – Competitive rates with minimal underwriting and servicing costs.

- Expanded Market Reach – Gain access to a network of serious borrowers ready to close.

- Higher Loan Quality – Thorough underwriting and risk assessment reduce defaults.

Check out our broker referral program to avail all the benefits.

FAQs

- How does a strong broker- lender relationship benefit borrowers?

A solid partnership between brokers and lenders creates a smoother loan process. Brokers with strong lender relationships can access better loan products, negotiate favorable terms, and resolve issues faster—giving borrowers a stress-free experience. - Do all mortgage lenders work with brokers?

Not necessarily. Some lenders only work directly with borrowers, while others prefer working through brokers. This is why a mortgage broker’s network matters—they connect borrowers with lenders that best suit their financial situation and loan needs.