If you’re a real estate investor struggling to qualify for conventional loans due to strict income verification requirements, DSCR (Debt Service Coverage Ratio) loans offer an easy alternative. Unlike regular mortgages that rely on tax returns and W-2s, DSCR loans assess whether a property’s rental income can cover its loan payments.

With the U.S. rental vacancy rate at 6.9% in Q3 2024, demand for rental properties remains steady, making DSCR loans a valuable option for expanding your portfolio without the hurdles of conventional financing.

In this blog, we will discuss the significant DSCR loan requirements, how they’re calculated, the main eligibility requirements, the credit score needed for DSCR loans and down payment expectations, and the types of properties that qualify.

How is DSCR Calculated?

DSCR is a crucial factor in determining loan eligibility. Lenders use this ratio to assess whether the rental income from a property is sufficient to cover the mortgage payment.

Formula

DSCR = Net Operating Income (NOI) / Total Debt Service

Where,

Net Operating Income (NOI): This indicates the income a property generates after operating expenses (like maintenance, taxes, etc.) are subtracted but before mortgage payments. It shows how much money the property earns from its operations.

Total Debt Service (TDS): This indicates the total amount needed to cover the property’s loan payments, including both principal and interest.

Understanding DSCR Result

- DSCR of 1.25 or higher: Strong financial standing (rental income exceeds debt obligations by 25%)

- DSCR of 1.0 : Break-even point (rental income just covers mortgage payments)

- DSCR below 1.0 : Negative cash flow (rental income is insufficient to cover loan payments)

Most lenders require a minimum DSCR of 1.0 to 1.25 for loan approval.

What Are the Minimum Requirements for a DSCR Loan?

Securing a DSCR loan requires meeting specific criteria that differ from regular mortgages. Understanding these requirements can help real estate investors determine if this financing option aligns with their investment goals.

Debt Service Coverage Ratio Criteria

Lenders usually require a minimum DSCR of 1.0 and 1.25 for loan approval. A DSCR of 1.0 means the property’s net operating income covers its debt obligations, while 1.25 indicates a 25% income surplus. Higher DSCR values provide a financial cushion, reducing risks from vacancies, market fluctuations, or economic downturns.

A higher DSCR (1.25 or above) improves loan approval chances, leading to lower interest rates, higher loan-to-value (LTV) ratios, and flexible repayment terms.

Borrowers with a DSCR closer to 1.0 may face stricter conditions, such as higher down payments and additional reserves. Loans for properties with DSCR below 1.0 are rare and usually come with higher interest rates and more stringent financial requirements.

Credit Score Requirement for DSCR Loans

For DSCR loans, most lenders require a minimum credit score of 550. A score of 700 or higher can help secure lower interest rates, better loan terms, and more flexible repayment options.

Borrowers with higher credit scores are seen as less risky, which translates to more favorable financing conditions. In contrast, those with lower credit scores may face higher down payments and stricter DSCR requirements. In some cases, higher interest rates may apply, or the borrower may be restricted to fewer loan options.

Improving a credit score before applying for a DSCR loan by paying off debts or correcting credit report errors can enhance loan approval chances. Some lenders may also allow co-signers or offer non-conventional loan products like bridge loans to accommodate lower scores.

Down Payment Requirements

For DSCR loans, the down payment ranges from 20-25% of the property’s value, with a common loan-to-value (LTV) ratio of 75-80%. A higher down payment can enhance loan approval chances by lowering the lender’s risk, leading to lower interest rates and better loan terms.

Larger down payments signal more significant financial commitment, making the loan less risky for lenders. Conversely, smaller down payments may result in higher interest rates and stricter requirements. Approval becomes more difficult for loans with less than 20% down and often comes with stricter terms.

Property Eligibility for DSCR Financing

Common property types eligible for DSCR loans include:

Single-family homes: These properties commonly qualify for DSCR loans due to their stable rental income potential.

Multi-family properties: Duplexes, triplexes, and fourplexes are also eligible, as they generate multiple income streams from tenants.

Short-term rentals: Properties listed on platforms like Airbnb may qualify, provided they generate enough income during rental periods.

Mixed-use properties: Properties that combine both residential and commercial spaces can be eligible for DSCR loans, offering diversified income sources.

Small commercial properties: These can also qualify, especially if they generate consistent rental income from business tenants.

Vacation rentals: May be subject to stricter requirements due to income volatility, depending on the lender’s policies.

High vacancy rates: Properties with high vacancy rates may need to show a stable cash flow to be eligible for DSCR loans.

Proof of Rental Income

Income requirements for DSCR loans require proof of rental income to ensure that the property can generate sufficient funds to cover its debt obligations. Commonly accepted documents to verify rental income include:

Current Lease Agreements: These agreements detail the rental terms, amount, and lease length with current tenants, providing a clear picture of the property’s rental income.

Rent Rolls: A rent roll is a detailed listing of the property’s tenants, rental amounts, and lease terms. It offers a comprehensive overview of income from all rented units, helping lenders assess the property’s total rental income.

Appraisal with Rental Income Estimate (Form 1007 for Residential Properties): This form, completed by a qualified appraiser, estimates the rental income the property could generate based on comparable market data and the property’s features. It provides a professional evaluation of the property’s potential income stream.

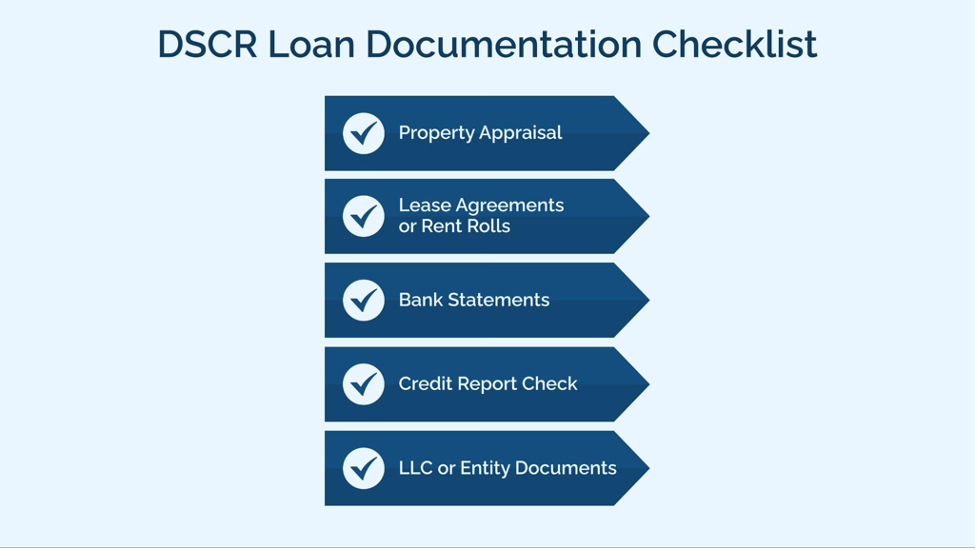

DSCR Loan Documentation Checklist

One of the biggest advantages of DSCR loans is the lack of personal income verification. Instead, lenders focus on the property’s income potential.

Property Appraisal: A professional appraisal is required to confirm the property’s market value and estimate its potential rental income. This ensures the property can support the loan payments based on its cash flow capacity.

Lease Agreements or Rent Rolls: If the property is already rented, current lease agreements or a rent roll must be provided to prove the ongoing rental income. This documentation helps lenders assess the stability and predictability of income.

Bank Statements: Lenders request bank statements to verify that the borrower has sufficient cash reserves to cover the mortgage payments in case of unforeseen vacancies or expenses. This provides an added layer of security for the lender.

Credit Report Check: Even though DSCR loans don’t require personal income verification, lenders still perform a credit report check to evaluate the borrower’s creditworthiness. A good credit score signals financial responsibility, making the borrower less risky.

LLC or Entity Documents: For investors purchasing through a business entity, lenders may require LLC or entity documents to verify the structure and legality of the business. This is essential for ensuring the loan is adequately secured through the business entity rather than the individual.

How Can You Improve the Chances of DSCR Loan Approval?

Lenders consider multiple factors beyond DSCR when approving loans. Here are some ways to strengthen your application:

Increase rental income: Optimize lease agreements by adjusting rental terms or offering longer lease durations to secure a stable income. Consider furnishing your rental units to attract higher-paying tenants, especially in competitive markets. Short-term rentals through platforms like Airbnb can generate higher returns than long-term leases. However, compliance with local regulations must be ensured to maximize profitability.

Lower property expenses: Reduce maintenance costs by conducting regular inspections and addressing minor issues before they become costly. Improve tenant retention by offering competitive amenities, responsive management, and lease renewal incentives. Check for better insurance rates and negotiate lower premiums by bundling policies or improving property safety features.

Maintain a strong credit score: Lenders consider your credit history when evaluating DSCR loans, so paying off outstanding debts can improve your approval chances. Avoid late payments, which can negatively impact your score and signal financial instability. Keep credit utilization low to demonstrate responsible credit management and increase your creditworthiness.

Save for a higher down payment: A larger down payment reduces the lender’s risk and may lower the DSCR requirement, making it easier to qualify. Aim to save at least 20-25% of the property’s purchase price to secure better loan terms. A higher equity stake also means lower monthly payments, improving your cash flow and financial flexibility.

Show strong reserves: Having at least six months’ worth of mortgage payments in reserve reassures lenders that you can handle financial setbacks. Substantial reserves indicate that you can continue making payments even if the property experiences temporary vacancies or unexpected expenses.

Need Financing That Works as Fast as You Do? Choose Bluestone Commercial Loans

Whether you’re a small business owner or a real estate investor, Bluestone offers:

- Bridge Loans: Get quick access to capital for time-sensitive transactions or refinancing. Secure the deal before conventional banks can even process your application.

- Fix-and-Flip Loans: Acquire and renovate a property smoothly. We provide funding to help you quickly purchase, rehab, and resell properties.

Why Choose Bluestone?

- Speed & Flexibility: We understand that time is crucial in your business. That’s why we offer fast, flexible financing solutions with competitive rates and minimal paperwork.

- Proven Success: Our portfolio includes a diverse range of high-quality business-purpose loans secured by commercial real estate. From small loans to multi-million-dollar investments, Bluestone has successfully financed numerous projects.

- Personalized Service: You’ll have direct access to Bluestone’s experienced team, ensuring we provide the right financial solution tailored to your needs. We take the time to understand your goals and work quickly to help you achieve them.

Take the next step toward your business goals with Bluestone Commercial Loans. Apply now and get funded in no time!