Choosing how to secure a mortgage is often more overwhelming than expected.

It’s easy to feel stuck between confusing terminology, varying interest rates, and competing advice from agents, lenders, and online sources.

One of the first decisions borrowers face is often the most confusing: Should you work with a mortgage broker or go directly to a lender?

Let’s take this scenario: you’ve found the right property, your offer has been accepted, and you’re on a deadline to finalize financing. You need to move quickly, but you also want to make the smartest financial choice.

While a mortgage broker offers access to multiple lenders and loan products, a direct lender offers a direct line to approval and a potentially faster closing. Both seem like viable options, so how do you choose?

The challenge isn’t just about access or speed. It’s about understanding how each option fits your financial profile, timeline, and level of involvement. Without that clarity, it’s easy to second-guess your decision down the line.

The truth is that brokers and direct lenders serve different needs. In this blog, we’ll explain how each one works, outline their advantages and limitations, and walk you through determining which path is right for you.

How You Borrow Matters: Know Who You’re Working With

When it comes to getting a mortgage, who you choose to work with can shape your entire experience. So before you start filling out applications, it’s essential to understand the difference between the two crucial players — mortgage brokers and direct lenders.

Mortgage Brokers

A mortgage broker is an independent intermediary between you and multiple lending institutions. Rather than lending money themselves, brokers evaluate your financial situation and shop around on your behalf, comparing loan products from a vast network of banks, credit unions, and other lenders.

This structure can be especially beneficial if:

- You have a non-traditional financial background (e.g., self-employed, variable income, or lower credit score).

- You want to compare rates and terms without applying to multiple institutions individually.

- You’re unfamiliar with the mortgage landscape and want guidance navigating available options.

Because brokers have established relationships with various lenders, they can secure loan terms that are more competitive than what you could obtain on your own. However, it’s crucial to understand how brokers are compensated. Some earn fees paid by the borrower, while others are compensated by the lender. Either way, it is better to maintain transparency when reviewing your loan estimate.

Direct Lenders

Direct lenders are financial institutions, such as traditional banks, credit unions, or private l companies, that originate, process, and fund loans using their own resources. When you choose a direct lender, you work with one entity from start to finish, which can simplify communication and reduce delays.

Direct lending may be ideal if:

- You have a strong credit profile and straightforward income documentation.

- You prefer a more centralized, predictable process.

- You’re already a customer of a particular institution and may qualify for loyalty discounts or faster service.

Direct lenders may offer quicker pre-approvals and a faster closing timeline as you work directly with the funding source. However, your options are limited to the lender’s own portfolio of loan products, which may not be as extensive or flexible as those a broker can access.

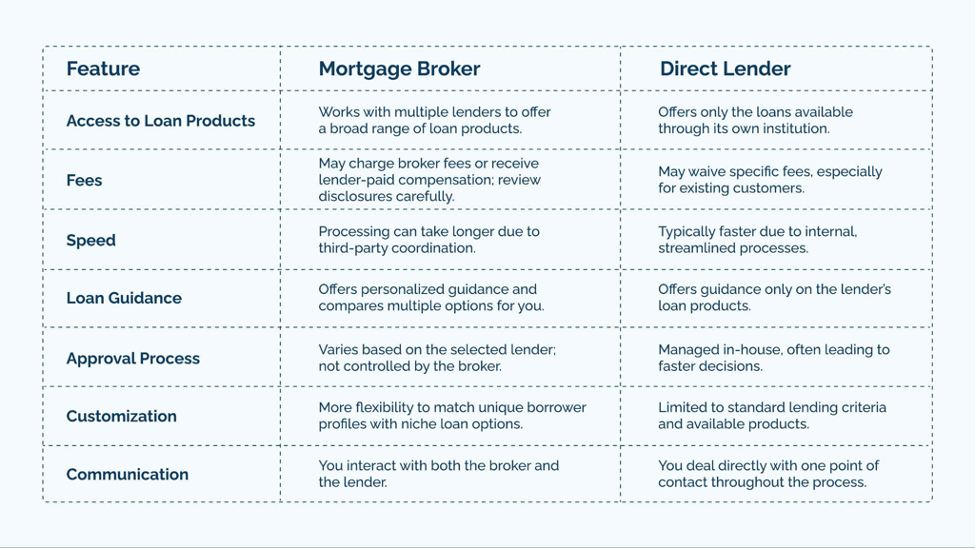

Mortgage Brokers vs. Direct Lenders: A Side-by-Side Comparison

Choosing between a mortgage broker and a direct lender often depends on how much flexibility, control, and involvement you want during the process. Here’s a detailed comparison to help you understand what sets these two options apart:

The Pros and Cons: What You Need to Know Before You Decide

There’s no one-size-fits-all answer when choosing between a mortgage broker and a direct lender. However, it’s crucial to understand how each route affects the loan process, cost, and overall experience. Here’s a closer look at what you gain and what you may have to give up when choosing a mortgage broker or direct lender:

Mortgage Brokers

Advantages

- Access to a Wide Range of Loan Products

Mortgage brokers work with multiple lenders, giving them access to various loan types, interest rates, and terms. This can be especially valuable for borrowers who want to explore multiple options without having to contact each lender individually.

- Suitable for Complex Financial Situations

If you are self-employed, have a variable income, a lower credit score, or are purchasing a non-traditional property, a broker can connect you with lenders who specialize in accommodating these types of profiles. Direct lenders may be more rigid in their qualification criteria.

- Offer Loan Matching Expertise

Brokers assess your financial background and compare different offerings to help find a loan that aligns with your goals and eligibility. This tailored approach can reduce the time and effort required to identify a suitable mortgage.

- Provide Assistance Throughout the Process:

Many brokers help coordinate communication between you and the lender, manage documentation, and monitor the application process to ensure everything stays on track. This can ease the burden, especially for first-time homebuyers.

Disadvantages

- Additional Fees May Apply

Brokers may charge fees for their services, which you or the lender can pay. These fees are typically disclosed upfront but add to your overall loan costs and should be factored into your decision-making.

- Less Control Over Processing Timelines

Because brokers rely on third-party lenders to underwrite and fund loans, they cannot directly control how quickly the process moves. Delays can occur if the lender’s internal operations are slow or backlogged.

- Potential for Conflicts of Interest

While most brokers act in their client’s best interests, some may be incentivized to work with specific lenders due to higher commissions or established relationships. It’s important to ask how your broker is compensated and to request loan comparisons from multiple lenders.

Direct Lenders

Advantages

- Streamlined Communication and Process

Working with a direct lender means that everything, from application to approval to funding, is managed within one institution. This reduces the likelihood of miscommunication and makes the process more straightforward.

- Faster Decision-Making and Closing

Since everything is handled in-house, direct lenders often process applications more quickly. This can be a decisive factor if you’re on a tight timeline.

- Potential for Fee Reductions or Incentives:

Existing bank or credit union customers may qualify for reduced fees, better interest rates, or preferred service. These loyalty perks can lead to cost savings and smoother interactions.

- More Predictability and Transparency:

With direct lenders, you typically work with one point of contact throughout the transaction. This consistency can make tracking progress easier and getting questions answered promptly.

Disadvantages

- Limited Loan Offerings

Direct lenders can only offer products from their institution. If their loan options don’t align with your financial goals or constraints, you may miss out on better rates or terms elsewhere.

- Borrowers Have to Do Comparison Shopping

Unlike brokers who do the shopping for you, borrowers working with direct lenders must contact multiple institutions on their own to compare rates and terms. This requires more time and effort, and you may still not see the full range of available options.

- May Not Accommodate Special Circumstances

Borrowers with non-traditional income sources, credit challenges, or other unique considerations may find that direct lenders have stricter underwriting guidelines. If your financial situation doesn’t fit within their criteria, your application could be declined or result in less favorable terms.

While mortgage brokers offer more choices and guidance, direct lenders offer a faster, more centralized experience, but with fewer loan options and less flexibility.

Ultimately, your decision should be guided by what you value most in the mortgage process, whether that’s a broader range of options, a more streamlined experience, greater flexibility, or faster turnaround times. Clarifying your priorities will help you determine which option best aligns with your financial needs.

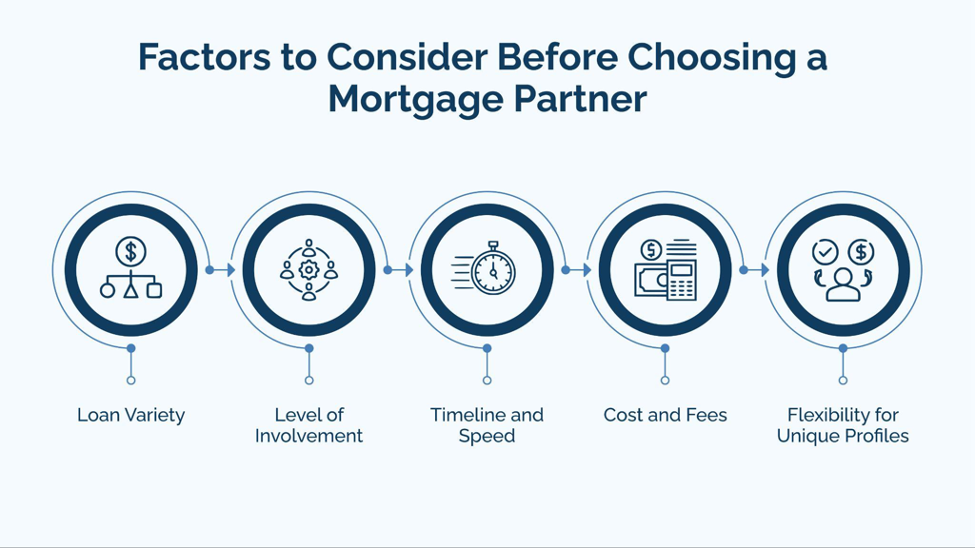

Factors to Consider Before Choosing a Mortgage Partner

Before you move forward with either a mortgage broker or a direct lender, it’s worth taking a step back and thinking through what matters most. Here are a few factors to consider:

Loan Variety

Mortgage brokers provide access to multiple lenders and a broader range of loan products. This can be especially helpful if you have a unique financial situation or want to explore different rate and term combinations. Direct lenders offer loans from a single institution, which may limit your options but can simplify the selection process.

Level of Involvement

Brokers handle comparisons and negotiations on your behalf, which can save time and reduce the complexity of choosing a loan. This is particularly useful if you’re unfamiliar with mortgage terms or want professional support navigating the process. With direct lenders, you’re responsible for researching and evaluating offers independently, which may require more effort but gives you complete control.

Timeline and Speed

Direct lenders often process applications more quickly since everything is managed internally, from underwriting to closing. With fewer parties involved, decisions can be made quicker, which is beneficial if you work with a tight schedule. On the other hand, brokers coordinate with third-party lenders, which may add time to the process due to additional layers of communication and approval.

Cost and Fees

Mortgage brokers may charge fees for their services or receive compensation from lenders, which can affect overall loan costs. These fees are typically disclosed early, but should be reviewed carefully. Direct lenders may offer more competitive pricing, especially to existing customers, and may waive specific fees to attract or retain business.

Flexibility for Unique Profiles

Brokers are often better equipped to assist borrowers with non-traditional financial situations, such as self-employment, fluctuating income, or lower credit scores. Their access to various lenders increases the likelihood of finding a lender working with your profile. Direct lenders generally have stricter lending criteria, which can be more limiting if your application doesn’t fit the standard mold.

Bluestone: Your Trusted Partner in Every Lending Path

At , we understand that choosing between a mortgage broker and a direct lender is only the beginning. What matters most is having the right relationship behind you—bringing speed, flexibility, and reliability to every deal.

Whether you’re a broker seeking tailored solutions for your clients or a borrower navigating complex financial needs, we’re here to support your goals with:

- Fast, Flexible Financing: Close in at least two weeks—ideal for time-sensitive transactions.

- Tailored Lending Solutions: Custom loan structures that align with real-world borrower scenarios.

- Trusted Industry Expertise: Responsive guidance and consistent support from start to finish.

- Proven Track Record: From mid-sized deals to multi-million-dollar commercial investments, our lending portfolio speaks for itself.

Strong lending partnerships drive better results and open the door to more opportunities. Let’s work together to move your next deal forward quickly and confidently.